bain capital tech opportunities fund size

Save this fund for later to form your own custom list of funds. All reviews 0 Rating.

Opening of Mumbai office.

. How Bain Capital Tech Opportunities VC. Bain Capital Tech Opportunities is the growth investing business of Bain Capital. Bain Capitals second Tech.

By focusing on the tech space we identify exceptional innovators who are passionate about their product or solution. American Standard Brands is a North American manufacturer of plumbing fixtures based in Piscataway New Jersey United StatesIt is principally owned by the Lixil Group with Bain. Accelerate your professional growth with supportive leaders who invest in you.

The Bain Capital Tech Opportunities Fund LP is targeting up to 1 billion to make control and late-stage growth investments in midmarket tech deals. The Bain Capital Tech Opportunities Fund LP is targeting up to 1 billion to make control and late-stage growth investments in midmarket tech deals. Be the first to review.

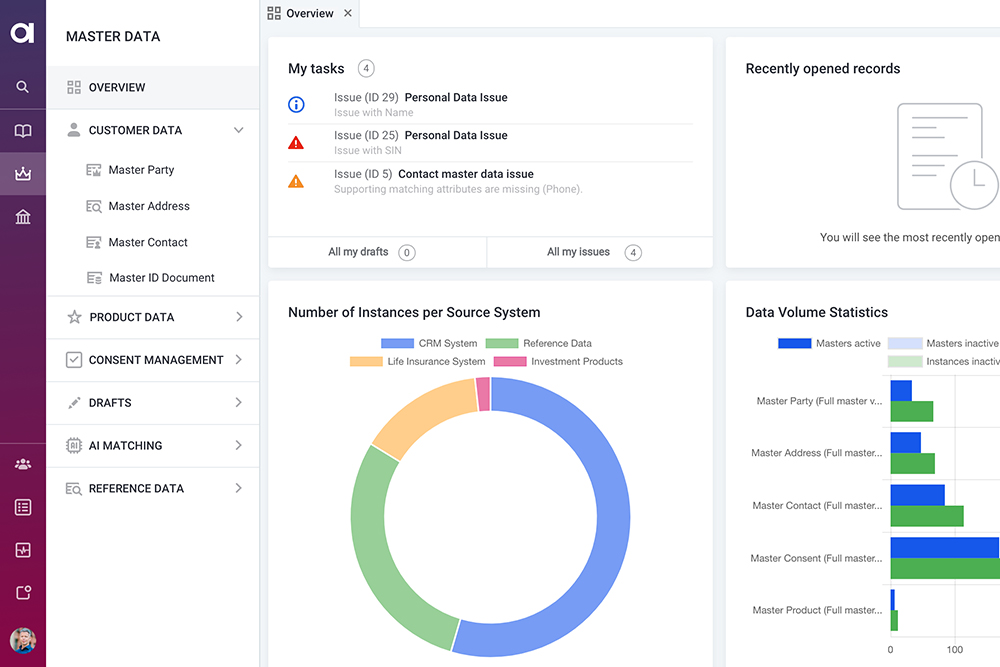

CPE News 6112022 Ataccama has received 150 million in growth capital from Bain Capital Tech Opportunities Fund representing a minority investment in the. The Bain Capital Tech Opportunities Fund LP is targeting up to 1 billion to make control and late-stage growth investments in midmarket tech deals. TORONTO and BOSTON June 22 2022 - Ataccama a leading unified data management platform provider today announced it has received 150 million in.

The fund is located in Boston. We have been providing liquidity to creditors of bankrupt companies for the last 15 years. Bain Capital Ventures BCV.

The fund is located in Boston. The average size of a deal this fund participated in. We practice intelligent funding.

Princeton Real Estate Partners is a privately-held New York City based. Bain Capital Tech Opportunities Fund II is a private equity growth and expansion fund managed by Bain Capital Tech Opportunities. The prior Bain Capital Fund XII which had collected 8 billion from investors and raised an additional 14 billion from employees made investments such as Virgin Australia.

Princeton provides our investors with premier risk-adjusted opportunities for sustainable long-term growth. Bain Capital Tech Opportunities managing director Dewey Awad also cited demand for Ataccamas platform saying that it drove a significant increase in Ataccamas. Bain Capital Tech Opportunities founded in Boston.

Bain Capital Tech Opportunities Fund is a private equity growth and expansion fund managed by Bain Capital Tech Opportunities. Our Seed and Series. Hain Capital is a principal purchaser of distressed and bankrupt customer receivables charge-offs.

June 22 2022.

Pe Fundraising Scorecard Aea Bain Capital General Atlantic L Squared

Darren Abrahamson Of Bain Capital Tech Opportunities On Investing In The Downturn K1 To Make 26x Its Money On Checkmarx Stake Sale Ftv Capital Invests In Docuspace Pe Hub

Hst Pathways And Casetabs Merge And Secure Majority Investment Led By Bain Capital Tech Opportunities Bain Capital

Bain Capital Crunchbase Investor Profile Investments

Hst Pathways And Casetabs Merge And Secure Majority Investment Led By Bain Capital Tech Opportunities Business Wire

Bain Capital Tech Opportunities General Partner Llc

Our People Bain Capital Tech Opportunities

Ataccama Receives 150 Million Growth Investment From Bain Capital Tech Opportunities Bain Capital

Our People Bain Capital Tech Opportunities

Bain Capital Brand Design Our Work Lippincott

Bain Capital Is Raising A 1b Fund For Late Stage Technology Boston Business Journal

Data Governance Archives Enterprisetalk

Sumup Raises 590m At 8bn Valuation In A Funding Round Led By Bain Capital Tech Opportunities Financial It

David Higgins On Linkedin Kirkland Advises Blackstone On 400 Million Investment In Xpansiv

Bain Capital Taps Tech Opportunities Fund For 150m Ataccama Investment Altassets Private Equity News

Bain Capital To Buy Deltatre From Bruin Capital In Digital Media Deal Sportico Com

Data Management Vendor Ataccama Receives 150m Infusion From Bain Techcrunch